At-fault Celebration Doesn't Have Adequate Insurance Coverage What Next?

Every one of this info might be very important when victims intend to go after an automobile accident claim to recover settlement for their losses. Insurance provider are leveraging mobile apps to improve the claims process and improve customer care. With these applications, motorists can quickly report accidents, upload photos of damage, and also launch insurance claims. While insurance policy can cover several expenses, having added savings can aid cover deductibles and various other out-of-pocket expenses quickly following a crash with a without insurance driver.

Primarily, the court claims if the at-fault driver has the money to Legal assistance for car accident settlements own these things, they can spend for the problems they've created you. This is why insurance policy agents, in addition to the Arizona Department of Insurance, encourage buying uninsured driver insurance coverage. When submitting an oversight case, you are required to show that the other vehicle driver caused the crash. In many cases, proving mistake is easy particularly if the other driver has actually been provided with a ticket in the past, or charged with negligent driving.

Take Advantage Of Vehicle Insurance Discount Rates

Whether you're travelling to function, chauffeuring your kids around or running tasks, there's a likelihood you're sharing the road with drivers that do not have automobile insurance. When accidents occur in an at-fault state, the insurance providers of both celebrations assess the details and make a judgment regarding which vehicle driver should be held responsible. Depending upon the information of the mishap, the process of determining that is or is not at fault in an accident can be straightforward or really complicated. You could possibly be held liable for pain and suffering or long-term loss of income as well, so it is essential that you have sufficient liability insurance to cover these expenditures. In several locations, driving without insurance policy can result in shedding your motorist's license.

Contrast Automobile Insurance Rates For 30-year-olds

- The average claim repayment for UMPD is $2,387, according to the NAIC.We do our ideal to make sure that this info is updated and exact.Idaho has the most affordable prices for chauffeurs with a drunk driving and The golden state is the most expensive, with a 121% hike, usually.But if they do not have automobile insurance, there is no insurer to handle your claim.

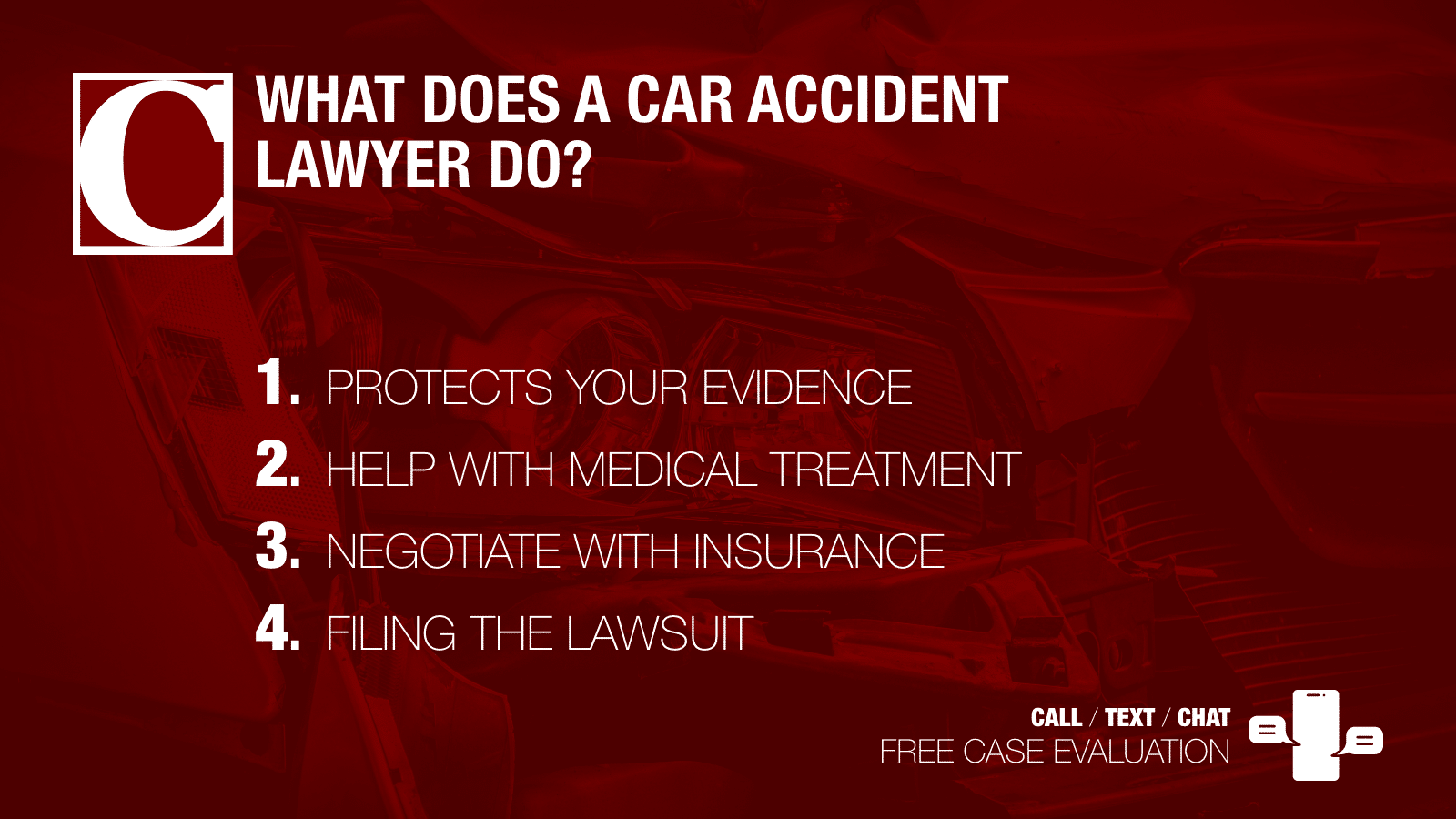

Urge conversations regarding the value of automobile insurance and share resources that can help others understand their alternatives for obtaining cost effective coverage. Always know your surroundings and anticipate the actions of other chauffeurs. Maintaining a secure distance, avoiding diversions, and https://jaidenjhhr552.raidersfanteamshop.com/8-reasons-you-require-a-cars-and-truck-accident-lawyer following traffic legislations reduce your risk of entering into an accident, whether with an insured or without insurance driver. Experienced lawyers have a record of discussing with insurer and promoting for their customers in court.

What Does Without Insurance Vehicle Driver Insurance Cover?

There are charges, alternatives for payment, and legal steps that might enter play. I advise searching at the very least every year or more for vehicle insurance policy with at least 3 firms for the same level of coverage and insurance deductible amount. Insurance firms have their own means of determining rates so rates can vary substantially. If you have various other chauffeurs in your home, their driving records influence your price. For instance, if you include a teen vehicle driver to your plan, be planned for a considerable bump in car insurance coverage premiums. For example, if you want crash mercy protection, check if this is used.